Fire Rated Glass Suppliers Take a New Look at Retrofits

Suppliers Take a New Look at Retrofits

As new construction stalls, fire rated glass suppliers take a new look at retrofits. This US Glass magazine article tracks retrofit projects that use fire rated glass.

Room for Improvement

While New Construction Stalls, Suppliers Take a New Look at Retrofits

by Megan Headley

As new commercial construction churns through its forecasted slump in 2010, the commercial glass industry is taking a closer look at ways to capitalize on opportunities in the retrofit market.

“It is a trend that is just getting started,” comments Rick De La Guardia, president of DLG Engineering Inc. in Miami. “I have worked on, and have seen, numerous condominiums and commercial buildings do a complete retrofit of their outdated windows and doors to more energy-efficient and safer products.”

Robin Randall, vice president of marketing for TRACO in Cranberry Township, Pa., is watching that trend take off as well. “We have seen an increase in retrofit projects, in large part due to the decline in new construction.”

Still, others say this growing trend might not be growing fast enough to really help buoy installers searching for work.

“The retrofit market right now is in the dumps with financing on the private sector side,” says Tom Johnson, executive vice president of the glazing contractor Burgess-Snyder Industries in Virginia Beach, Va. “On the state level I think cities are in somewhat of a squeeze and we have not seen much retrofit work hit the streets. Most of the work we’ve seen has been new construction.”

He adds, “I’ve worked with architects on some condominium projects that are desperately in need of door and window work as part of their overall renovation, but they’re strapped to get loans as well. There are a limited number of projects I think that are going to be available to us this year. I’m not too optimistic that this year is going to be as good as last year.”

|

“The downturn has affected nearly every aspect of the market. Renovation projects would have to significantly increase in order to offset the losses in other commercial segments,” adds Jeff Griffiths, director of business development at SAFTIFIRST Fire Rated Glazing Solutions. However, he acknowledges, “An increased emphasis on energy performance improvements, the need to align older buildings with today’s technological needs and the ability to tap into equity for funding are all important factors that could cushion the blow to the renovation market segment.”

While retrofit revenues for Minneapolis-based Apogee Enterprises historically have been about 25 percent, Russ Huffer, chairperson and chief executive officer, has said this may change with the right incentives.

“If the government were to put retrofit incentives in place it could grow,” he says. “There is no question that retrofit can significantly change the energy performance of older buildings.”

Already, Huffer says, he is seeing increased interest as a result of “stimulus projects.” He adds, “We’ve also seen interest from non-government projects, but many of these projects are not moving ahead with the difficulty in obtaining financing.”

Mark Meshulam, executive vice president of Builders Architectural in Deerfield, Ill., agrees that the retrofit work might not be there now—but now is precisely the time to prepare for work in this segment.

“Right now there’s been such a huge decrease in all kinds of work that it’s hard to say,” Meshulam says. He adds, “I believe that the fastest part of our industry’s market to return will be rehab, first in the public sector, then the private sector.”

Seeking Incentives

Despite dour predictions for 2010, Associated General Contractors of America chief executive officer Stephen Sandherr tried to spin a silver lining out of the gray cloud hanging over commercial construction during a recent forecast he pointed out that low costs of materials and labor provide good deals for municipalities to begin a construction project.

“As new federal producer price index figures … make clear, construction material costs are at multi-year lows, which is why places like Maryland’s Montgomery County are moving forward with aggressive capital plans despite tight budgets. They know they’re getting good deals for construction now and that if they wait, these projects will only cost more.”

Sandherr added that the association was contacting Congressional and administration leaders to urge them to invest in construction activity. “If they act now, they can save taxpayers millions on construction costs while immediately boosting employment and economic activity,” he said.

While glass products may not be among those discounted materials, it is an incentive that could get the ball rolling on some renovation projects that require less of an overall investment than new construction—particularly when suppliers and installers help to explain how glass products ultimately can offer huge cost savings.

According to a report published by McGraw Hill Construction in October 2009 entitled “Green Building Retrofit & Renovation,” the downturn is encouraging adoption of energy-efficient practices in renovation projects as suppliers promote the long-term money-saving benefits of energy-efficient products. The report further states that all owners surveyed reported using more energy-efficient lighting or natural daylighting in their green retrofit and renovation projects. In other words, building owners looking to retrofit know improvements in glass will have a big return on investment. So how to get the other owners to consider replacing their inefficient windows?

“It is always important to explain how replacing products can improve the performance of the units and consequently the overall structure dramatically,” Randall says. She adds, “We have noticed an increased requirement for energy-efficient products in all segments of the fenestration industry.”

Promoting the cost-saving benefits of glass and related products can only help increase those requirements. Suppliers more than ever before are promoting the energy-efficient properties of their products—and with good reason, as that McGraw Hill report also predicts green building renovations to jump from 5 to 9 percent of the market to 20 to 30 percent in just five years. That jump may start sooner rather than later as less than 20 percent of building owners surveyed indicated that they used bank loans to finance green retrofit and renovation projects. The report attributes this in part to the tightening of credit that has occurred since the fall of 2008 and the relatively low costs of many renovation projects. Instead, building owners are looking to alternative financing measures such as the services of an energy service company (ESCO). ESCOs, the report explains, finance the upfront cost of the retrofit and take a percentage of the savings achieved.

Meshulam advises glass industry professionals to promote their energy—and cost—benefits based on a three-pronged approach by addressing: tax benefits available to help with the immediate costs, longer-term energy savings and the existing data that documents the enhanced market value of properties with green upgrades.

“That can be quite persuasive. There’s data out there that indicates that the cost to retrofit windows can be recouped to a very great extent by the increased market value of the property,” Meshulam says. “A formula that puts all of those things together can create a persuasive message.”

Huffer cites similar data. “Often when monolithic glass is replaced, there are huge energy savings to be achieved, as well as increases in comfort and productivity for employees with the improved energy efficiency and greater use of daylighting. The improvements also increase the value of the building and can lead to increased lease rates for building owners,” he says.

With regard to those tax benefits in Meshulam’s first prong, Sandherr cited the stimulus bill as another bright spot for contractors. “The approximately $135 billion in construction funds included in last year’s package are now beginning to have a measurable, but limited, impact on the construction industry,” he said.

The American Recovery and Reinvestment Act (ARRA) set aside $750 million for updating federal buildings and United States courthouses for energy efficiency and $4.5 billion toward converting GSA facilities to high-performance green buildings.

Still, Huffer says, “The stimulus projects are a positive for the market but are impacting a fraction of the total capacity that is available.”

Higher Learning

In addition to federal buildings, educational institutions are making the most of government assistance. According to the McGraw Hill report, the sectors with the largest green retrofit opportunity are education and office—approximately 50 percent of all retrofit activity.

Information from the U.S. Department of Energy states that funds are available for financing energy efficiency and renewable energy measures in public and private non-profit schools. Schools, school districts and higher education institutions are advised to work with state or local energy offices to develop energy conservation strategies. And in a news release issued on November 23, 2009, the National Institute of Building Sciences explained that the federal government’s Qualified School Construction Bond (QSCB) program, created by the ARRA, provide tax credits, in lieu of interest paid by the state or district, to bondholders as a more efficient source of funding. The states and districts that issue the bonds will be responsible only for paying back the principal, making it possible for them to purchase land, build new buildings and/or renovate existing buildings at a savings of up to 50 percent (visit www.edfacilities.org/school-modernization/ for more information).

School districts seem to be taking advantage of these incentives. TRACO’s projects are a good example of school demand for energy-efficiency; when asked about retrofits projects to which it has recently supplied, a very exclusive list is offered ranging from Slippery Rock Elementary to the University of Detroit, and all education points in between.

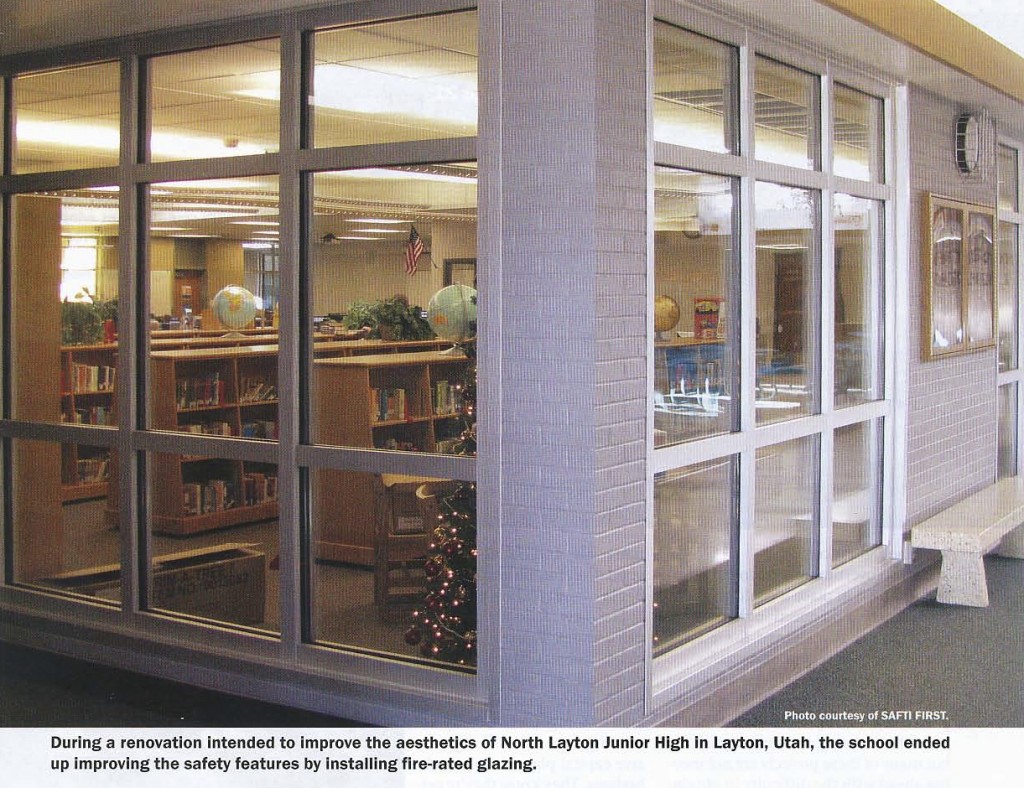

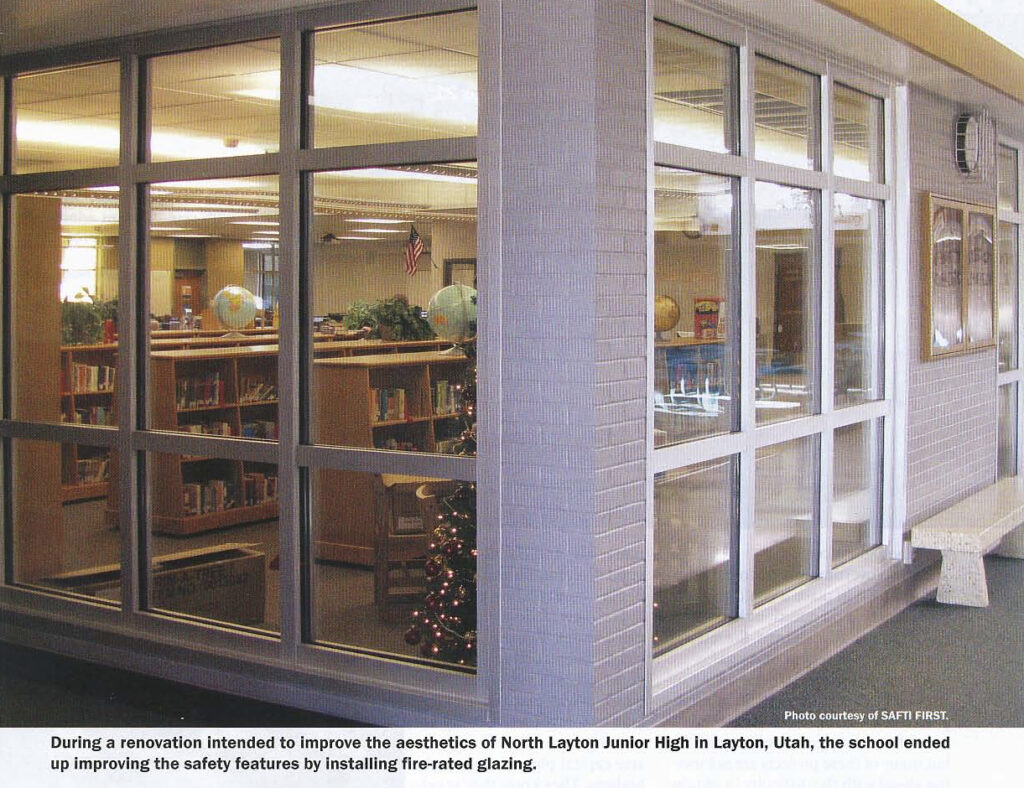

Diana San Diego, director of marketing of SAFTI FIRST in San Francisco, also sees this playing out. “We are seeing a lot of school renovation work going on—and it seems that school districts are taking this opportunity to upgrade the glazing. This includes eliminating the old wired glass to a fire and safety product, making windows more energy-efficient, increasing the amount of glazing to maximize daylighting or expanding artificial light, etc.”

But as San Diego cautions, while energy efficiency upgrades may be the motivation, as with any renovation new products are being brought into to meet existing codes.

“Safety and technology can be two important reasons to renovate,” adds Griffiths. “Existing conditions can be considered unsafe based on current code requirements. Technological advancements, whether they may be a result of electronic media or energy efficiency, for example, can drive the need to upgrade older facilities.”

Rolling with the Punches

De La Guardia currently is assisting in the retrofit of an historic building in Miami, the Vizcaya Museum and Gardens, to provide a flood-resistant storefront system. As he’s learned, renovation projects can become more extensive then originally planned to meet existing codes.

“There have been several code changes in recent years that will affect this,” he says. “If you have an old [building]and it’s not properly designed to today’s code you may not have an issue solely with the doors and windows, but you might have an issue with a structure that wasn’t designed to transfer the loads from the windows and doors.”

–Tom Johnson, Burgess-Snyder Industries

Installers need to be sure that they’re looking at all of the existing codes and are updating not simply for energy properties or aesthetics, but safety as well—and need to be sure that the existing structure can support today’s new products.

Randall notes that other often-overlooked considerations include integrating the new door or window system with existing building envelope systems.

“The goal is always to improve the total performance of the doors and windows using the most innovative technology to improve air, water, thermal and structural performance,” she says. “This contributes to the overall performance of the building envelope.”

Griffiths adds, “Tying into existing waterproofing materials and methodologies can be tricky and requires having a wider range of experience and knowledge.”

New technologies, in addition to updated codes, can affect the way a retrofit project is installed. “The biggest trend that I’m seeing with replacement and even new construction is the use of expandable foams in the space between the edge of the window and the building substrate,” Meshulam comments. “We never saw that before about two years ago, and now it seems like almost every job has it. That will help the energy performance in terms of making the surfaces feel warmer and it also isolates the edge of the window from cold air that might be in the wall cavity.”

Another not-to-be-overlooked consideration remains aesthetics, particularly in historic buildings.

“There is the challenge of maintaining the current aesthetics/historical look of the building with the new energy-efficient systems,” Huffer says.

Randall adds, “Depending upon the era of the building, often times retrofit projects require the aesthetics of the building to match or be similar to the existing condition.”

Gaining Retrofit Experience

Companies with experience in renovation projects certainly will have an easier time capitalizing on these opportunities, and installers may want to seek out suppliers that promote renovation-specific products.

“You have to be experienced with retrofit projects to be able provide solutions and provide products that maximize performance,” Randall says.

In the end, though this market may help some companies create new opportunities, right now it’s still an overall smaller market feeding a large number of competitors.

As Johnson says, “We’re going after what’s out there in the commercial market, be it retrofit or new construction. I do believe this is going to be a down year for all of us. I don’t see as many projects, so with the available work that’s going to be out there for the many firms that are going to be chasing it, it’s going to be pretty competitive. We have a backlog, but I think by the end of the year we’ll be wishing we had a larger one.”

In those cases, the most that can be done is to lay the groundwork for jobs early in the recovery cycle.

“The idea is to create a clear value proposition for the customer,” Meshulam says. “It’s not going to cause people who don’t have money to spend it. But if those messages can be hammered out now, then when the economy starts to loosen up there should be some pent-up demand. If the [architects and building owners] have been educated during this interim period as to the benefits, they might move quicker. They might already have figured out who they want to work with—whoever’s providing that information now.”

Megan Headley is the editor of USGlass

Source: US Glass, Metal & Glazing Magazine, February 2010